In today’s fast-paced digital world, the way we conduct transactions and handle payments has undergone a significant transformation. From e-commerce businesses catering to global markets to individual consumers making everyday purchases, the need for a secure, flexible, and reliable payment solution has become paramount. As you explore the world of digital payments, finding the perfect Visa Mastercard alternative can be a game-changer, revolutionizing the way you handle financial transactions.

Table of Contents:

- Visa Mastercard: Unraveling the Features

- Global Acceptance

- Wide Range of Credit Cards

- Secure Transactions

- Rewards and Benefits

- Contactless Payments

- Limitations of Visa Mastercard

- Fees and Charges

- Dependency on Banks

- Geographical Restrictions

- Potential Fraud Risks

- Why Explore Visa Mastercard Alternatives?

- Diverse Payment Options

- Lower Processing Fees

- Innovations in Digital Payments

- Enhanced Security Measures

- Why Choose an Alternative?

- American Express (Amex)

- Discover

- PayPal

- Apple Pay

- Google Pay

- Samsung Pay

- Cryptocurrencies

- Skrill

- Neteller

- Venmo

- Join the Future of Payments Today!

Visa Mastercard: Unraveling the Features

As two of the most widely recognized and accepted payment networks globally, Visa and Mastercard have solidified their positions as preferred choices for consumers and businesses alike. Understanding the features that make them stand out can help you make an informed decision when exploring alternatives:

Global Acceptance

One of the primary strengths of Visa and Mastercard lies in their extensive global acceptance. These payment networks are supported by countless merchants and financial institutions worldwide, making them convenient for international travelers and businesses with a global presence.

Wide Range of Credit Cards

Both Visa and Mastercard offer a wide range of credit cards tailored to different consumer needs and lifestyles. From basic credit cards to premium ones with exclusive benefits, users can choose cards that align with their preferences and financial goals.

Secure Transactions

Visa and Mastercard prioritize the security of their users’ financial information. They employ robust security measures such as encryption, tokenization, and fraud detection to safeguard transactions and protect users from unauthorized activities.

Rewards and Benefits

Credit cards issued by Visa and Mastercard often come with rewards programs, offering cashback, travel miles, discounts, and other enticing benefits. These rewards add value to cardholder experiences and encourage spending within the network.

Contactless Payments

Both Visa and Mastercard have embraced contactless payment technology, allowing users to make quick and secure transactions by tapping their cards or devices on compatible payment terminals. This feature promotes a seamless and hygienic payment experience.

Limitations of Visa Mastercard

While Visa and Mastercard have numerous advantages, they also come with certain limitations that might prompt individuals and businesses to explore alternative payment options:

Fees and Charges

Visa and Mastercard transactions may involve various fees and charges, including interchange fees, processing fees, and foreign transaction fees. These costs can impact business profitability and personal finances, prompting some users to seek alternative payment solutions with more competitive pricing structures.

Dependency on Banks

As credit card networks, Visa and Mastercard depend on the issuing banks that provide their credit cards. This interdependency can lead to different policies and customer service experiences across various banks, potentially affecting the user’s overall satisfaction.

Geographical Restrictions

While Visa and Mastercard are globally recognized, some regions or countries may have limited acceptance or restrictions on their usage. This limitation can be an inconvenience for travelers or businesses operating in specific markets.

Potential Fraud Risks

Despite robust security measures, credit card transactions are not immune to fraud risks. Users may encounter unauthorized transactions or identity theft, leading to potential financial losses and the need for enhanced security features.

Why Explore Visa Mastercard Alternatives?

Exploring alternatives to Visa and Mastercard opens up a world of possibilities, each catering to specific needs and preferences. Here are some reasons why you might consider embracing a different payment solution:

Diverse Payment Options

Alternative payment solutions offer a diverse range of options, including digital wallets, cryptocurrencies, and specialized e-commerce payment platforms. Choosing an alternative that aligns with your specific requirements can enhance your financial flexibility.

Lower Processing Fees

Visa and Mastercard may involve higher processing fees for certain transactions. Exploring alternatives with more competitive fee structures can lead to significant cost savings, especially for businesses processing high volumes of transactions.

Innovations in Digital Payments

The world of digital payments is evolving rapidly, and innovative solutions are continually emerging. By exploring alternatives, you can leverage cutting-edge technologies and features that improve transaction speed, security, and user experience.

Enhanced Security Measures

Some alternative payment methods may offer additional security layers, such as biometric authentication or blockchain technology. These enhanced security measures can provide added peace of mind during financial transactions.

Why Choose an Alternative?

While Visa and Mastercard are widely accepted, and dominant players in the payment industry, exploring alternative options can offer unique benefits and features that cater to specific needs. Let’s take a closer look at some popular alternatives to Visa and Mastercard:

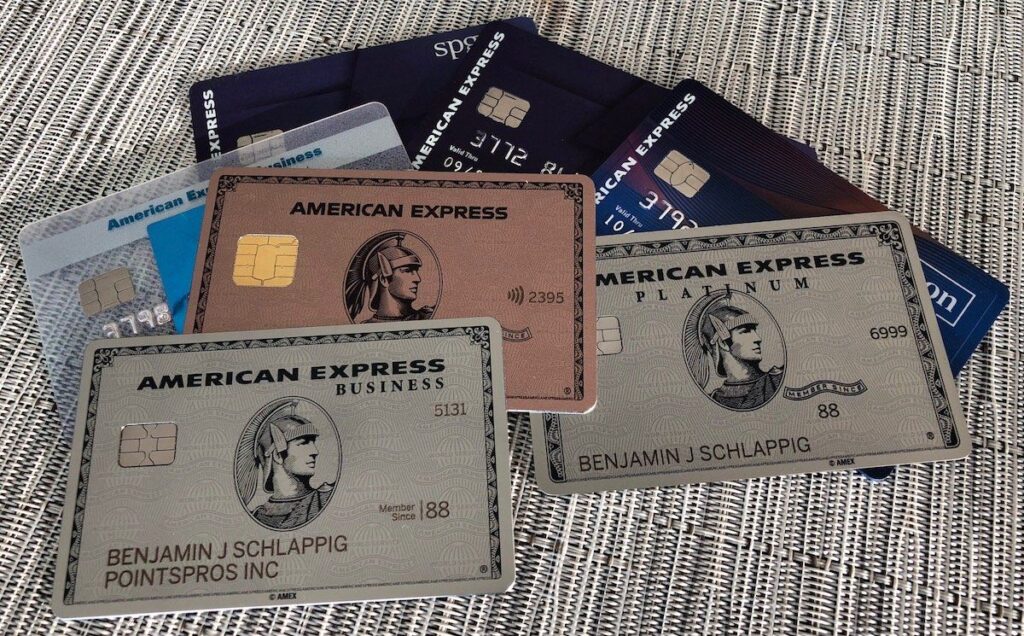

1. American Express (Amex)

American Express is a well-known credit card company that offers a range of credit cards with various rewards and benefits. It is widely accepted worldwide and is particularly popular among higher-income individuals and businesses.

2. Discover

Discover is another major credit card issuer known for its cashback rewards and excellent customer service. It is widely accepted in the United States and provides competitive rates and benefits.

3. PayPal

PayPal is a leading digital payment platform that allows users to send and receive money online securely. It is widely used for e-commerce transactions and is available in many countries.

4. Apple Pay

Apple Pay is a mobile payment service provided by Apple that allows users to make contactless payments using their iPhone, Apple Watch, or iPad. It is a convenient and secure way to pay for purchases in physical stores and apps.

5. Google Pay

Google Pay is a digital wallet platform developed by Google that enables users to make payments using their Android devices. It supports both contactless payments in stores and online transactions.

6. Samsung Pay

Samsung Pay is a mobile payment service offered by Samsung for Samsung Galaxy smartphones and wearables. It uses both NFC and MST (Magnetic Secure Transmission) technology, allowing it to work with most payment terminals.

7. Cryptocurrencies

Cryptocurrencies like Bitcoin, Ethereum, and Litecoin are gaining popularity as alternative payment methods. They offer fast, secure, and decentralized transactions, making them attractive options for some users.

8. Skrill

Skrill is an e-commerce payment system that allows users to send and receive money online, making it a popular choice for international money transfers and online purchases.

9. Neteller

Neteller is an e-money transfer service that offers secure online payments and money transfers. It is widely used in the online gambling and forex trading industries.

10. Venmo

Venmo is a mobile payment service owned by PayPal, primarily used for peer-to-peer payments and splitting bills among friends. It is popular among younger users in the United States.

Each of these alternatives has its unique features, advantages, and user base. When choosing an alternative to Visa and Mastercard, consider factors such as acceptance, security, fees, rewards, and the specific needs of your business or personal preferences.

Join the Future of Payments Today!

As you navigate the ever-changing landscape of payment solutions, choosing the right partner is critical for your business’s success. Embrace the future of payments by exploring these alternatives to Visa and Mastercard. Upgrade your payment experience and unlock a world of possibilities for your business or personal financial needs.

Embrace Innovation – Experience a New Era in Payments

Seize the opportunity to adopt cutting-edge payment solutions that align with your requirements. Embrace innovation and stay ahead of the curve in the fast-paced world of digital transactions.

Convenience and Security Combined

Experience the convenience and security of modern payment methods. Simplify your financial transactions and enjoy peace of mind knowing your money is in safe hands.

Make the Switch Today!

The time is now to explore these Visa Mastercard alternatives and make the switch to a payment solution that suits your lifestyle or business needs. Embrace the future of payments and embark on a journey towards seamless, efficient, and secure financial transactions.