Navigating shared expenses is simplified through cutting-edge financial tools, often referred to as the “Splitwise alternative.” These platforms redefine collaborative finance, offering streamlined expense tracking, real-time synchronization, and transparent reporting. With user-friendly interfaces, settling debts and splitting bills becomes effortless. As the demand for seamless group financial management rises, the quest for the perfect “Splitwise alternative” intensifies, prompting the exploration of innovative solutions designed to enhance efficiency and promote financial harmony.

Exploring the Landscape: Features and Limitations of a Splitwise Alternative

This analysis explores a Splitwise alternative and highlights key features, including robust expense tracking and real-time synchronization. The user-friendly interface and transparent reporting promise efficient financial management. However, potential limitations such as integration challenges, subscription costs, security concerns, and a learning curve should be considered.

Key Features of Splitwise Alternatives:

- Comprehensive Expense Tracking: Robust tools ensure detailed individual and group expense tracking.

- Real-Time Synchronization: Seamless integration with bank accounts and diverse payment platforms.

- User-Friendly Interface: Intuitively designed platform for easy navigation and enhanced accessibility.

- Transparent Reporting: Detailed reports provide valuable insights into spending patterns.

Potential Limitations of Splitwise Alternatives:

- Integration Challenges: Possible compatibility issues with specific banks or payment methods.

- Subscription Costs: Premium features are often accompanied by subscription fees.

- Security Concerns: Potential risks associated with linking personal financial data.

- Learning Curve: Initial challenges for new users adapting to the platform interface.

What Sets a Splitwise Alternative Apart?

In the landscape of collaborative financial management, a Splitwise alternative stands out by offering innovative features that go beyond conventional solutions. These alternatives redefine the user experience through enhanced customization, broader integration capabilities, and advanced reporting tools. Whether it’s a more intuitive interface, specialized tracking options, or additional security measures, what sets these alternatives apart is their ability to address specific user needs and preferences, providing a tailored and efficient solution to shared expense management.

The Need for a Splitwise Alternative

he analysis delves into the limitations and evolving preferences that prompt users to look beyond traditional solutions like Splitwise. We will examine diverse financial needs, customization demands, integration flexibility requirements, and the rising importance of advanced security measures. This exploration aims to provide insights into the growing demand for alternatives that cater to varied collaborative financial arrangements and offer enhanced features for a seamless user experience.

1. Diverse Financial Preferences

Recognizing users’ diverse financial needs, the quest for a Splitwise alternative arises from the understanding that individuals engage in varied collaborative financial arrangements. Some users may require a more straightforward solution for basic expense tracking, while others seek advanced tools for managing intricate group finances. The need for a versatile alternative is fueled by the desire to accommodate different levels of financial complexity and collaboration styles.

2. Customization Demands

Traditional platforms may fall short of meeting the increasing demand for customization in financial management. Users often seek alternatives that empower them with the ability to personalize expense categories, reporting templates, and overall interface to align with their unique preferences. The need for a Splitwise alternative is driven by a desire for a tailored experience that caters to specific financial habits and preferences.

3. Integration Flexibility

The landscape of financial institutions and payment platforms is vast and diverse. Users, therefore, demand a Splitwise alternative that offers broader integration capabilities. The need arises from the desire for seamless connectivity with various banks and payment platforms, ensuring a more comprehensive and connected financial ecosystem. Flexibility in integration allows users to have a consolidated view of their finances without constraints.

4. Advanced Security Measures

As digital transactions become more prevalent, data security and privacy concerns intensify. Users seeking a Splitwise alternative prioritize platforms that implement advanced security measures to safeguard personal and financial information. The need for heightened security is a significant driver in the search for alternatives, ensuring users can trust the platform with their sensitive financial data in the ever-evolving digital landscape.

Commonly Preferred Splitwise Alternative: Widely Used Shared Expense Management Platforms

This exploration will delve into widely adopted shared expense management platforms that offer efficient and innovative features. From streamlined expense tracking to user-friendly interfaces, we will provide an overview of these alternatives, highlighting their unique capabilities and why they are commonly favored by users seeking robust solutions for collaborative financial management.

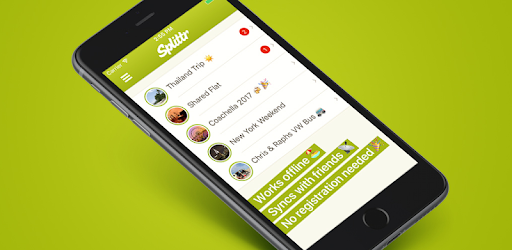

1. Splittr

Tailored for travelers and groups with shared expenses, Splittr offers a practical solution for on-the-go expense tracking. Supporting multi-currency transactions, the app simplifies the process of dividing expenses among friends. Its real-time synchronization and offline functionality make Splittr a versatile choice, especially for those managing expenses in diverse locations.

2. Zelma

Zelma stands out among expense management alternatives with its robust tools for detailed individual and group expense tracking. The platform leverages AI-driven insights to provide users with valuable information about their spending patterns. Real-time synchronization with various financial institutions ensures accurate and up-to-date financial data. Zelma’s intuitive interface and customizable reporting tools contribute to a user-friendly experience, making it a top choice for those seeking a comprehensive solution for shared expenses.

3. Settle Up

Settle Up simplifies group expense management, focusing on user-friendly design and ease of use. Ideal for bill splitting and settling debts within groups, the app supports multiple currencies, seamlessly catering to international transactions. With straightforward features and a hassle-free interface, Settle Up ensures a convenient financial collaboration experience for users.

4. Tricount

Tricount excels in group expense management, providing users with an effortless way to track and split expenses. The collaborative platform allows group members to add expenses and settle debts seamlessly. With support for currency conversion, Tricount is particularly well-suited for international groups, offering a comprehensive solution for shared financial responsibilities.

5. Splid

Splid stands out for its user-friendly interface and efficient expense management capabilities. The app simplifies bill splitting, expense tracking, and debt settlements. Splid’s ability to generate detailed PDF reports is noteworthy, which is appealing to users who prioritize comprehensive documentation of their financial activities.

6. Tab

Tab focuses on transparency in group expense management, providing real-time updates on shared expenses. The app supports multiple payment methods and features a user-friendly design for seamless navigation. Tab’s emphasis on clear communication and straightforward functionality makes it a reliable choice for users seeking an uncomplicated solution.

7. Spend Together

Spend Together prioritizes simplicity and convenience in splitting bills and tracking shared expenses. With real-time synchronization and automated notifications, users can easily stay informed about their financial commitments. The app’s straightforward design appeals to users who prefer an uncomplicated solution for managing shared expenses.

8. Kittysplit

Designed for scenarios like trips and events, Kittysplit simplifies the process of sharing costs among participants. The app offers transparency and flexibility, allowing for easy adjustments and settlements. Kittysplit’s focus on user-friendly collaboration and seamless financial coordination makes it a popular choice for group finance.

9. Divvy

Divvy distinguishes itself with advanced expense tracking and reporting tools. The platform provides a transparent environment for group finances, allowing users to categorize expenses and generate detailed reports. Divvy’s emphasis on analytics and insights sets it apart, offering users a deeper understanding of their financial dynamics.

10. Expensure

Expensure combines intuitive design with powerful expense-tracking capabilities. With support for real-time synchronization, the app ensures users stay updated on shared expenses. Its collaborative features and detailed reporting options cater to diverse group financial needs, making Expensure a comprehensive solution for effective expense management.

Unveiling the Excellence: Five Key Factors of Splitwise Alternatives

Through in-depth analysis, we’ll delve into intuitive user interfaces, robust expense-tracking capabilities, real-time synchronization benefits, customization flexibility, and advanced security measures. Each factor will be dissected to provide a comprehensive understanding of why Splitwise alternatives excel in providing a seamless and secure collaborative financial management experience.

1. Intuitive User Interfaces

Splitwise alternatives prioritize accessibility with intuitively designed user interfaces. Engineered for user-friendly navigation, these platforms ensure a seamless experience for individuals of varying financial expertise. The intuitive interfaces empower users to effortlessly manage complex financial tasks, from tracking expenses to facilitating group settlements, fostering an inclusive and straightforward user experience.

2. Robust Expense Tracking

Their proficiency in providing robust tools for individual and group expense tracking sets these alternatives apart. Users gain valuable insights into their spending habits thanks to comprehensive tracking features. This functionality enhances financial management and promotes transparency within shared expenses, offering users a detailed overview of their financial landscape.

3. Real-Time Synchronization

A standout factor is seamless integration with diverse financial institutions and payment platforms, ensuring real-time synchronization. This feature guarantees that users always have access to accurate and up-to-date financial information. The ability to synchronize data in real-time facilitates informed decision-making, minimizing discrepancies and providing a reliable foundation for collaborative financial activities.

4. Customization Flexibility

Recognizing the diverse financial needs of users, Splitwise alternatives offer enhanced customization features. Users can tailor expense categories, reporting templates, and interfaces to align with their unique preferences. This level of customization ensures a personalized and adaptable financial management experience, accommodating a variety of collaborative financial arrangements and meeting the specific needs of users.

5. Advanced Security Measures

Security stands as a paramount factor in the realm of financial management, and Splitwise alternatives address this concern with advanced measures. These platforms implement robust protocols to safeguard personal and financial information, instilling confidence in users regarding the protection of their sensitive data. The emphasis on advanced security measures creates a secure environment that fosters trust and facilitates secure collaborative financial activities.

Conclusion

Exploring cutting-edge “Splitwise alternatives” reveals streamlined expense tracking, real-time synchronization, and transparent reporting, simplifying collaborative finance. This analysis highlights key features and potential limitations and delves into what sets these alternatives apart. The exploration concludes with an overview of widely adopted shared expense management platforms, showcasing their unique features for efficient financial collaboration.