Are you concerned about the security of your online transactions? Worried about potential data breaches or unauthorized charges on your credit card? Look no further! At SecurePay Solutions, we understand your privacy concerns, and we are committed to providing you with a top-notch Privacy.com alternative for all your online payment needs.

Table of Content

- Introduction

- The Need for Privacy.com Alternative

- Introducing SecurePay

- How SecurePay Works

- Registration Process

- Virtual Cards and Disposable Card Numbers

- Transaction Monitoring and Alerts

- Why Choose SecurePay over Privacy.com?

- Broader Merchant Acceptance

- More Payment Options

- Enhanced Security Features

- Transparent Fee Structure

- Superior Customer Support

- Realizing the Benefits: SecurePay in Action

- Safe Online Shopping Experiences

- Streamlined Business Payments

- Protecting Travel and Leisure Expenses

- How to Get Started with SecurePay

- Conclusion

1. Introduction

In today’s fast-paced digital world, online transactions have become an integral part of our daily lives. From shopping and paying bills to booking flights and accommodation, the convenience of online payments is undeniable. However, with the increasing prevalence of cyber threats, safeguarding your financial data has never been more critical.

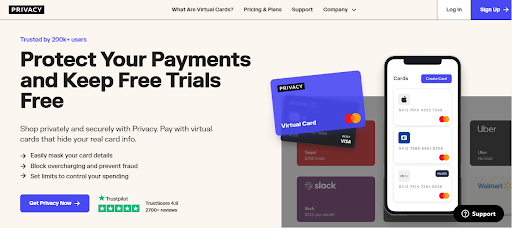

In recent years, we have witnessed a surge in data breaches and identity theft cases, leaving consumers worried about the security of their credit card information when conducting transactions on the Internet. Privacy.com, a well-known service, has been a popular choice for those seeking to protect their sensitive details by generating virtual cards. While Privacy.com offers a level of security, it’s essential to explore other options that provide even greater peace of mind without compromising on convenience.

2. The Need for Privacy.com Alternative

The growing need for secure online payment solutions is evident. As technology advances, so do the methods employed by cybercriminals to exploit vulnerabilities and gain unauthorized access to personal information. Online fraud, phishing attempts, and card-not-present (CNP) fraud have become all too common, making consumers rightfully cautious about sharing their credit card information on various websites.

While Privacy.com has served as a trusted option for many, it’s essential to assess whether it meets all your specific requirements. As an informed consumer, you deserve to have access to a comprehensive online payment solution that not only ensures security but also provides a seamless and versatile experience.

3. Introducing SecurePay

SecurePay takes pride in being a leading player in the online payment industry. The platform is designed to address the growing concerns of privacy-conscious individuals like yourself, providing a secure, fast, and reliable payment method for all your online transactions.

We understand that trust is paramount when it comes to handling your financial data, and that’s why SecurePay has built a robust and user-friendly system that prioritizes your privacy and security above all else.

4. How SecurePay Works

SecurePay’s mission is to provide you with a hassle-free and secure online payment experience. Let’s delve into the key features that set SecurePay apart from Privacy.com:

– Registration Process

Getting started with SecurePay is a breeze. Simply visit their website at https://www.securepay.com.au/ and click on the “Sign Up” button. Their registration process is quick and straightforward, allowing you to set up your account within minutes.

– Virtual Cards and Disposable Card Numbers

One of the cornerstones of SecurePay’s security measures lies in the generation of virtual cards and disposable card numbers. When you create a SecurePay account, you gain the ability to generate virtual cards and disposable card numbers linked to your primary account. These virtual cards act as a buffer between your actual credit card details and the online merchant, ensuring that your sensitive information remains protected from potential hackers.

With disposable card numbers, you can also enjoy an added layer of security during one-time transactions. These numbers are valid for a single purchase only, minimizing the risk of fraudulent activities and unauthorized recurring charges.

– Transaction Monitoring and Alerts

We recognize the importance of staying informed about your financial activities. With SecurePay’s real-time transaction monitoring and instant alerts, you will receive notifications for every payment made using your virtual cards. This proactive approach empowers you to keep track of your expenses and swiftly identify any suspicious activity.

Their state-of-the-art monitoring system scans transactions for unusual patterns or irregularities, allowing you to take prompt action in the event of unauthorized use.

5. Why Choose SecurePay over Privacy.com?

While Privacy.com has been a popular choice for those seeking virtual card services, SecurePay offers distinct advantages that make it a worthy alternative. Let’s explore these benefits in detail:

– Broader Merchant Acceptance

SecurePay has fostered partnerships with a diverse network of merchants across various industries. This means that you can use your SecurePay virtual cards on a broader range of online platforms, including e-commerce websites, subscription services, and more. Their aim is to provide you with unparalleled flexibility and convenience, ensuring that you can securely shop wherever you choose.

– More Payment Options

SecurePay’s commitment to versatility extends beyond virtual cards. While Privacy.com primarily focuses on virtual card generation, SecurePay offers additional payment options, such as ACH transfers and eChecks. This means that you can make payments in a manner that best suits your preferences and requirements, all while enjoying the same level of security and peace of mind.

– Enhanced Security Features

While both Privacy.com and SecurePay prioritize security, we believe in going the extra mile. Their platform employs advanced encryption and multi-factor authentication mechanisms to fortify your account against potential threats. With SecurePay, you can rest assured that your financial data is safeguarded by cutting-edge technologies, reducing the risk of unauthorized access or fraudulent activities.

– Transparent Fee Structure

SecurePay’s core business model is transparency. We understand the frustration that hidden fees can cause, and that’s why the fee structure at SecurePay is straightforward and upfront. With SecurePay, you won’t encounter any surprises or unexpected charges, allowing you to budget and manage your expenses more effectively.

– Superior Customer Support

Exceptional customer support is an integral part of the SecurePay experience. A team of dedicated professionals is available 24/7 to address any queries, concerns, or technical issues you may encounter. They prioritize prompt and effective communication, ensuring that you receive the assistance you need when you need it most.

6. Realizing the Benefits: SecurePay in Action

Now that we have explored the advantages of SecurePay over Privacy.com, let’s delve into how SecurePay can enhance various aspects of your life, providing you with a secure and convenient payment solution:

– Safe Online Shopping Experiences

When you use SecurePay’s virtual cards for online shopping, you gain an added layer of security that protects your credit card information from potential data breaches and fraudulent activities. Enjoy the freedom to shop at your favorite online stores, confident in the knowledge that your sensitive data remains shielded.

– Streamlined Business Payments

For business owners, SecurePay offers a streamlined approach to managing financial transactions. Whether it’s paying vendors, managing expenses, or tracking company finances, their platform simplifies the process while ensuring that your business’s financial information remains secure.

– Protecting Travel and Leisure Expenses

Traveling for business or pleasure comes with its own set of expenses. With SecurePay, you can confidently make hotel bookings, flight reservations, and leisure purchases, knowing that your financial data is protected from potential threats.

7. How to Get Started with SecurePay

Are you ready to experience the convenience and security of SecurePay for yourself? Getting started is as easy as 1-2-3:

- Visit the website at https://www.securepay.com.au/.

- Click on the “Sign Up” button and follow the simple registration process. Remember to choose a strong and unique password to secure your account further.

- Once your account is set up, you can begin creating virtual cards and disposable card numbers right away.

8. Conclusion

In conclusion, SecurePay Solutions offers a robust and secure alternative to Privacy.com, providing you with a comprehensive online payment solution that prioritizes your privacy and peace of mind. Their user-friendly platform, combined with broader merchant acceptance, additional payment options, enhanced security features, transparent fees, and exceptional customer support, sets SecurePay apart as the go-to choice for secure online transactions.

Make the switch to SecurePay today and embrace worry-free online payments!